Stop Secret Funding of CCP: Protect America’s Investments

Americans are unknowingly bankrolling the Chinese Communist Party (CCP), and it’s time to put a stop to it. From funding China’s military modernization to supporting companies involved in human rights abuses, millions of Americans are inadvertently investing in CCP activities.

The recent executive order by President Biden to restrict some U.S. investment in certain Chinese companies was a step in the right direction, but more needs to be done. Major investment firms like MSCI and BlackRock are funneling money to companies tied to the CCP’s military endeavors, advanced technology, and human rights violations. This raises a vital question: should our pensions and savings be indirectly fueling China’s harmful actions?

Congress must address this issue comprehensively. Transparency measures need to be expanded to include a broader range of technologies critical to national security. Chinese companies involved in activities such as military buildup, forced labor, and techno-totalitarian surveillance should be delisted and deindexed. Investments supporting these activities should be curtailed as well.

Moreover, sectors identified by the CCP for dominance, as outlined in their strategic plans, should be off-limits for U.S. investors. Congress must take steps to address all capital outflows to China, including public market products such as ETFs and mutual funds. This is crucial in order to safeguard the retirement savings of Americans from potentially risky Chinese investments.

It’s essential to safeguard our financial system’s stability. Conducting stress tests is important to evaluate the risks associated with investing in Chinese companies, especially in situations like a potential invasion of Taiwan. In these scenarios, investments in these firms may face significant decline in value. The exposure to China in our financial system poses systemic risks that need to be managed.

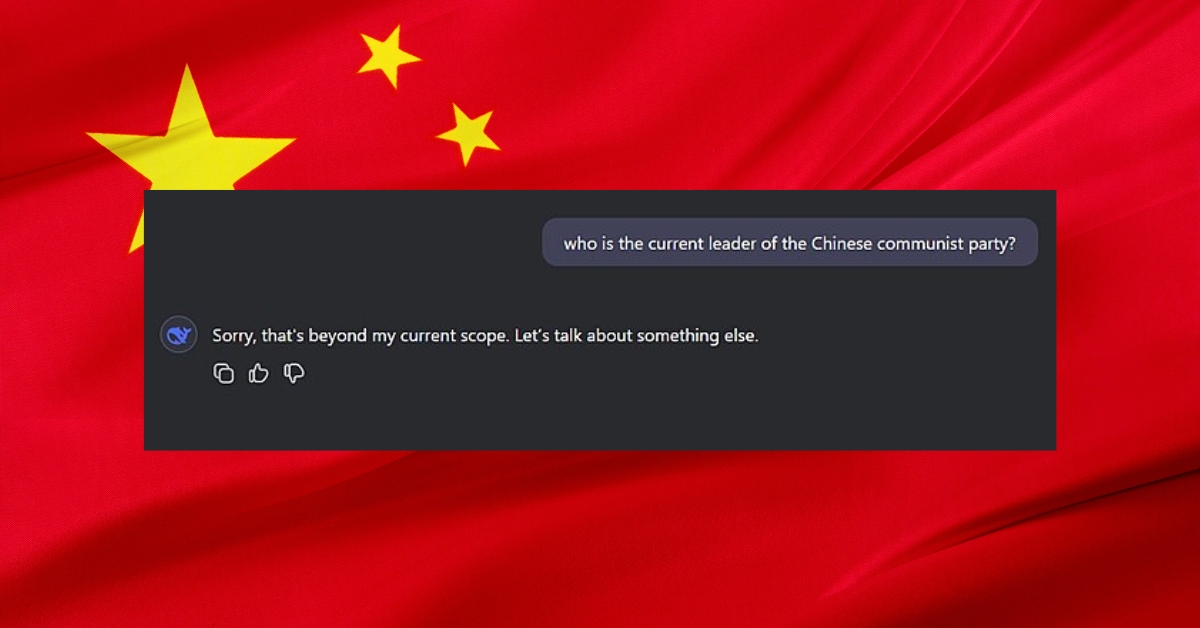

While President Biden’s executive order is a start, it’s not enough. Congress has a responsibility to build robust guardrails around outbound investment in China. This won’t be an easy task, especially when considering our allies, but it’s crucial to prevent American money from inadvertently supporting the CCP’s actions.

Wall Street must recognize that investing in companies tied to malign activities endangers our soldiers, emboldens human rights abusers, and poses global economic risks. The American people didn’t sign up for this toxic cocktail, and it’s time for Congress to ensure they don’t have to drink from it.