Real Cost of Charging an Electric Vehicle Equivalent to $17.33 per Gallon

The true cost of “fueling” an electric vehicle (EV) over a 10-year period is equivalent to $17.33 per gallon of gasoline, according to a recent analysis by the Texas Public Policy Foundation (TPPF). This figure takes into account various factors, including direct and indirect subsidies, regulatory mandates, and the costs borne by taxpayers, utility ratepayers, and buyers of EVs.

EV advocates often cite a $1.21 cost-per-gallon equivalent for charging an EV, but the TPPF argues that this figure excludes the real costs imposed on society, which total $48,698 per EV. These costs include subsidies to buyers of EVs and chargers, indirect subsidies such as avoided fuel taxes and fees, as well as grid-related expenses for utilities, and regulatory mandates like fuel economy standards and zero-emission requirements.

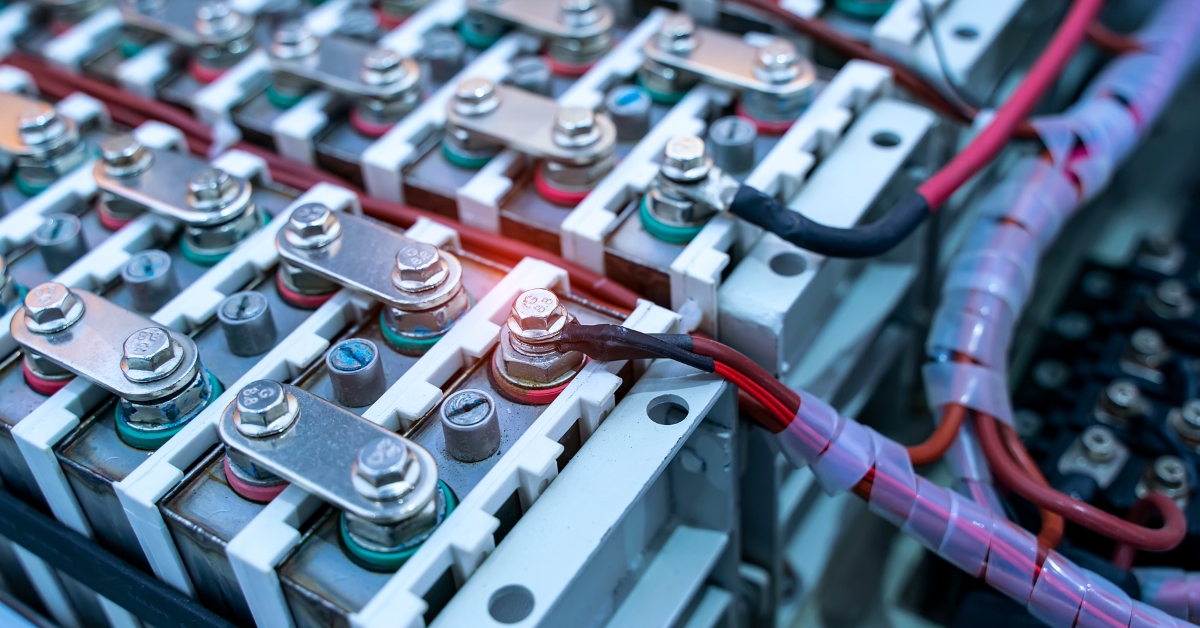

The study also assumes that EVs will be driven for 10 years and 120,000 miles. It acknowledges that EVs lose an average of 2.3% of their range each year due to battery degradation, resulting in faster depreciation compared to internal combustion cars.

The authors point to the case of the Ford Lightning, estimating that it costs over $150,000 due to subsidies and losses incurred by the manufacturer. This high cost is carried by everyone, including non-EV owners and those without cars.

To arrive at the $17.33 per gallon equivalent figure, the TPPF created categories for costs borne by different groups, including EV owners, taxpayers, utility ratepayers, and buyers of electric vehicles. The cost per gallon equivalent is calculated by dividing the total cost presented by the number of miles an average new vehicle can travel over its ten-year lifetime, using an average fuel efficiency of 36 miles per gallon equivalent.

EV owners, according to the analysis, pay $1.21 for residential electricity and $1.38 for charging and metering costs per equivalent gallon. However, taxpayers pay $2.72 per gallon in federal and state EV buyer tax credits and rebates. Utility ratepayers contribute $0.40 per gallon in avoided charging infrastructure costs. They also pay $3.18 per gallon to cover the increased costs associated with enabling the grid for mass-scale EV charging.

Buyers of non-electric vehicles face increased costs totaling $1.48 per gallon equivalent due to state requirements for manufacturers to sell a certain number of often money-losing EVs. Additionally, they pay $1.01 per gallon equivalent due to EPA GHG emissions standards, and Corporate Average Fuel Economy (CAFE) Credits add a significant $5.96 per gallon equivalent.

CAFE standards represent the largest externalized cost for EVs. Automakers that do not meet the necessary average fuel economy must purchase credits from manufacturers with excess credits. These credit markets contribute billions of dollars annually and significantly impact the bottom line of EV manufacturers like Tesla. To encourage the adoption of non-gasoline or diesel vehicles, the federal government established a 667% multiplier in miles per gallon equivalent (MPGe) for alternative power vehicles. As a result, an EV with a 300-mile range can be worth 507 MPGe in credits, exceeding the direct losses incurred by manufacturers on their EVs.

This analysis highlights the comprehensive costs of EV ownership that go beyond the price of electricity and affect various stakeholders, calling into question the perception of EVs as a cost-effective and environmentally-friendly alternative to traditional vehicles.

Critics argue that subsidies and regulatory mandates have distorted the market and contributed to the high cost of EVs, raising concerns about their long-term sustainability and the burden they impose on taxpayers and consumers.

Ultimately, the study underscores the importance of a holistic approach to assessing the economic and environmental impact of EVs while considering the trade-offs and unintended consequences associated with government interventions in the automotive industry.