Ford to Slash Production of F-150 Lightning EV

The recent announcement from Ford Motor Company that it plans to reduce production of their F-150 Lightning electric pickup truck reflects a significant change in the automotive market. Ford’s decision to shift from three shifts to just one at its Michigan Rouge Electric Vehicle Center beginning April 1st underlines a broader industry trend: the demand for electric vehicles (EVs) is softening.

This adjustment in Ford’s production strategy is emblematic of the challenges facing the EV market. Despite the Biden Administration’s aggressive push towards electric vehicles, the reality on the ground seems to be diverging. The administration’s aim for 67% of all new vehicles to be EVs by 2032 appears to be overly ambitious, especially in light of current market dynamics and consumer preferences. In fact, this mandate has faced opposition from Detroit automakers, who argue that these emissions regulations are too extreme.

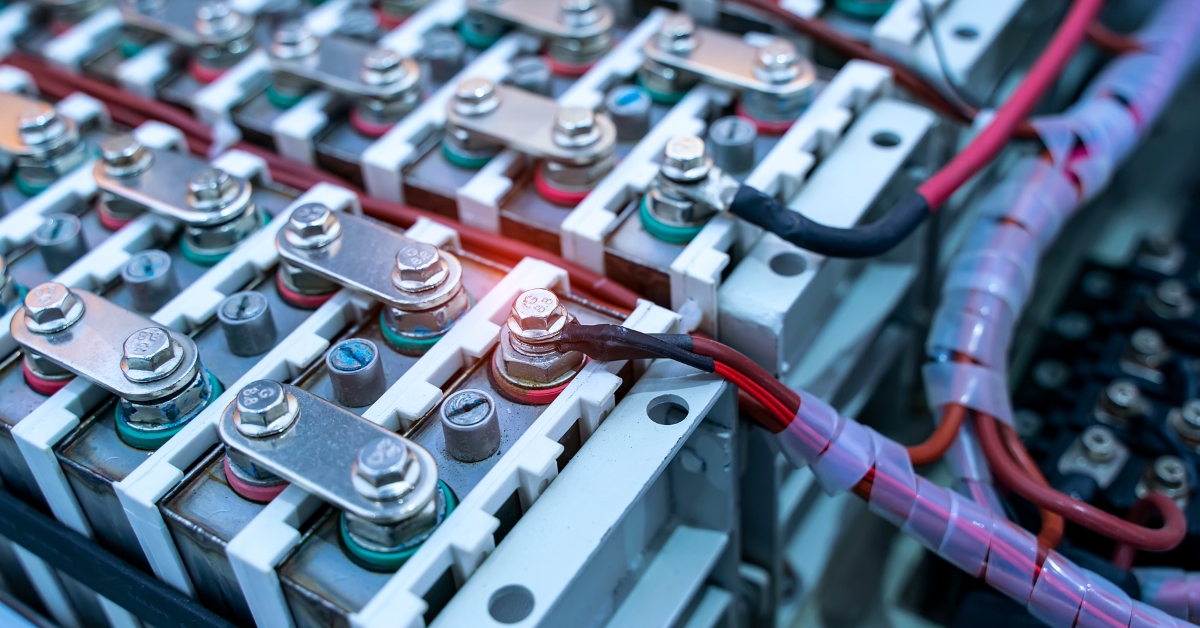

The automotive industry’s pivot towards electric vehicles has been a cornerstone of the Biden Administration’s environmental policy. This push includes substantial investments in EV and battery production, as well as funding for new EV charging infrastructure. However, Ford’s decision to scale back production, along with similar moves by other automakers like General Motors, suggests that the market may not be ready for a rapid transition to electric vehicles.

Ford’s focus seems to be recalibrating towards more immediate market demands. The company plans to add a third crew and create nearly 900 jobs at its Michigan assembly plant to ramp up production of gas-powered Bronco SUVs and Ranger pickups. This move aligns with market realities and consumer preferences, indicating a continued interest in traditional gasoline vehicles.

The reduction in electric F-150 Lightning production will impact 1,400 workers at the plant. Ford’s management strategy involves reallocating around 700 of these employees to its Michigan Assembly Plant and other roles within the company or offering them a special retirement program. This reflects a prudent approach to workforce management, considering the changing market dynamics.

Ford’s estimation of EV sales growth being “less than anticipated” in 2024 is a sobering acknowledgment for the EV market. It also highlights the challenges legacy car manufacturers face in balancing the shift towards electric vehicles while meeting current market demands. The focus on hybrid models, which have seen increased buyer interest, suggests a more measured approach towards vehicle electrification.

In conclusion, Ford’s production cutback is more than just a company-specific adjustment; it represents a broader industry recalibration in the face of evolving consumer preferences and market realities. This development calls for a reevaluation of aggressive EV policies and underscores the need for a more balanced approach to vehicle electrification, one that aligns with market demands and technological readiness.