Biden’s $850M Green Energy Loan to Battery Maker Enriches China

In a move that encapsulates the stark contradictions and questionable decisions at the heart of the Biden administration’s green energy agenda, an $850 million conditional loan intended to bolster the United States’ battery production capabilities and reduce dependency on China has instead become a point of controversy. The loan, awarded to KORE Power for constructing a battery production plant in Arizona, was heralded as a stride towards strengthening the domestic supply chain. However, revelations about KORE’s intimate connections with a Chinese battery manufacturer, Do-Fluoride New Materials (DFD), raise alarming questions about the true beneficiaries of American taxpayer dollars and the administration’s commitment to national security and economic independence.

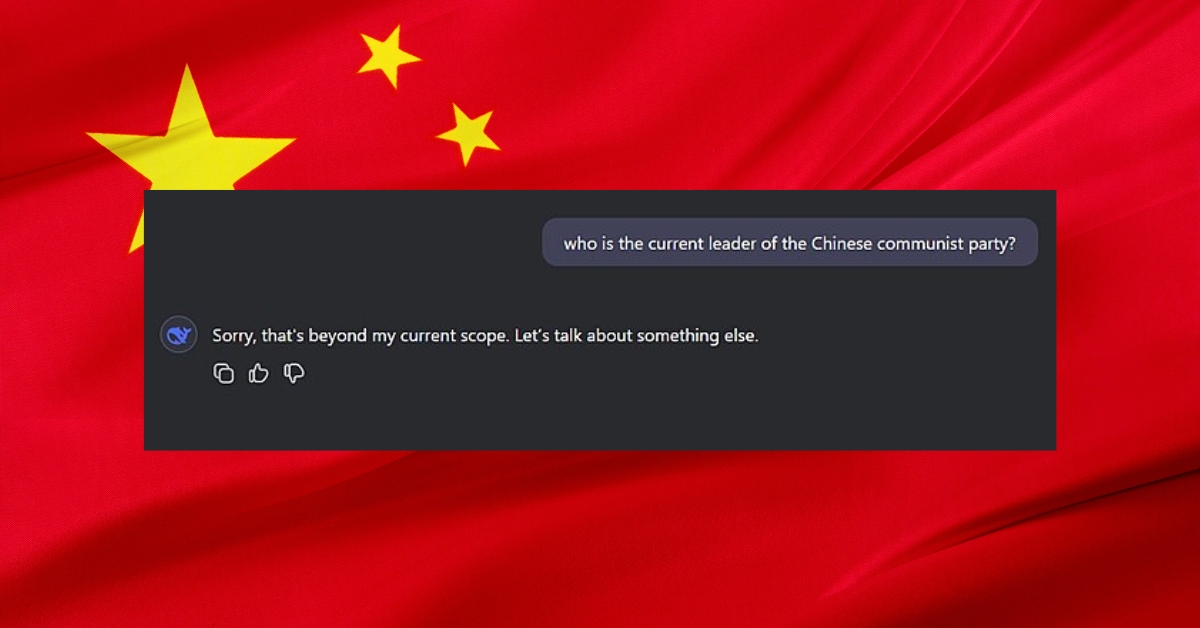

KORE Power, with its modest workforce and Idaho headquarters, initially presented an image of American enterprise poised to challenge China’s stranglehold on the global battery market. Yet, this facade crumbles under scrutiny, revealing a 14% ownership by DFD—a company entwined with the Chinese Communist Party (CCP) and represented on KORE’s board by the daughter of a CCP official. This intricate web of affiliations starkly contradicts the stated goal of diminishing American reliance on Chinese technology and expertise.

The involvement of DFD in constructing the Arizona facility, as confirmed by KORE’s CEO and the Department of Energy, further muddies the waters. While the Department of Energy assures that extensive due diligence was performed, the partnership’s endorsement seemingly contradicts legislative intentions to foster U.S. technological autonomy.

This episode is not an isolated incident but part of a worrying pattern for the Biden administration’s green energy initiatives. The cancellation of a $200 million grant to another battery maker, Microvast, after its primary operations in China were exposed, underscores a systemic failure to adequately safeguard American investments from exploitation by foreign entities closely aligned with adversarial governments.

Critics, including watchdog groups and experts on China, have voiced concerns over the apparent lack of oversight and the naivete of funding projects that entangle American resources with companies under significant Chinese influence. The revelation that KORE’s operations hinge entirely on DFD’s battery and module production lays bare a stark dependency, contradicting the initiative’s purported aim to wean off Chinese dominance.

Furthermore, the historical backdrop of technology theft and litigation involving DFD, coupled with its entrenched connections to the CCP, casts a long shadow over the wisdom of engagements with such entities. The involvement of CCP-linked individuals in key positions within KORE, and the company’s lobbying efforts that smacked of cronyism, only add to the perception of a deal fraught with conflicts of interest and questionable judgment.

The case of KORE Power serves as a cautionary tale of how noble intentions can be subverted by inadequate vetting and a lack of strategic foresight, resulting in outcomes that contradict stated goals and compromise national interests. As the United States endeavors to secure its technological future and economic independence, it must ensure that its resources do not bolster the very competitors it seeks to surpass.