Biden’s $369 Billion Green Slush Fund

Recent reports have shed light on a meeting between the CEO and lobbyists of Rivian, an electric vehicle manufacturer, and John Podesta, Biden’s Climate Czar. Podesta is in charge of distributing $369 billion from the so-called “Inflation Reduction Act” (IRA), and his meeting with Rivian representatives raises concerns about potential favoritism toward green companies amid their financial struggles. While Biden’s administration touts green initiatives, it appears that the taxpayers may end up bailing out these companies.

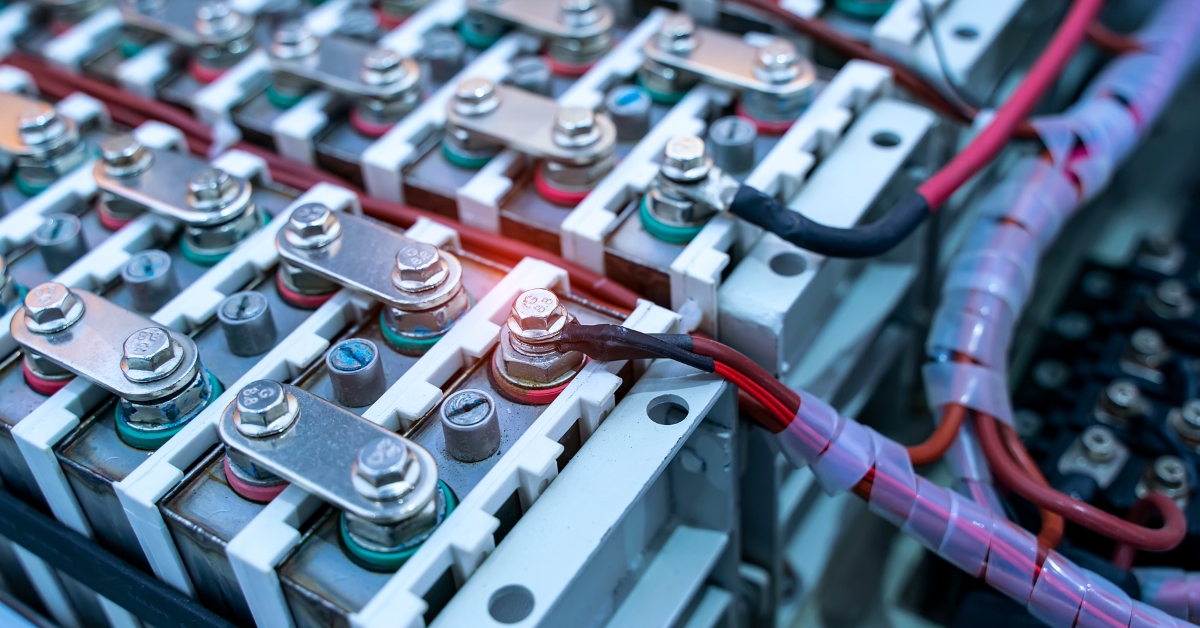

Rivian, a prominent electric vehicle manufacturer, is reportedly in significant financial trouble. In recent years, the company has suffered substantial losses, with $6.8 billion in 2022, $4.7 billion in 2021, and an additional $1 billion in 2020. These staggering losses are particularly striking considering the generous subsidies that EV manufacturers have received. President Biden himself praised Rivian in early 2022, despite the company’s declining stock value, which had already lost 87% of its worth since 2021. This situation raises questions about whether green companies are receiving preferential treatment under the Biden administration.

Critics have expressed concerns about how taxpayer dollars are rapidly disbursed through the IRA. The Department of Energy’s Inspector General has highlighted the risks and stated that the current situation poses a considerable danger to taxpayers. Concerns about the potential misuse of taxpayer funds, including funds flowing to foreign companies or being wasted domestically, have been raised. Despite these concerns, senior Biden administration officials have been unresponsive to the warnings. The Inspector General points out that “billions and billions of dollars” were lost or misappropriated from federal COVID-19 relief funds, and the IRA’s slush fund is even larger.

The “green banks” aspect of the IRA has come under particular scrutiny. Green banks are designed to fund environmentally friendly projects that regular banks may not support. Unlike traditional banks, green banks do not need to be profitable to survive because they are funded by the government. New Mexico Governor Michelle Lujan Grisham’s efforts to establish a green bank without legislative approval have raised concerns. The bank’s board would consist of green non-profit organizations, potentially giving them control over hundreds of millions of dollars. Critics view this as a problematic political fund, with concerns about transparency and accountability.

Congress is closely monitoring green bank initiatives, recognizing their potential for abuse. The key concern is that the Biden administration has put Podesta, a political operative, in charge of what should be an apolitical fund, raising questions about the favoritism shown to green companies. Critics argue that while the Obama administration viewed some entities as “too big to fail,” the Biden administration may be taking it a step further by making certain green initiatives “too favored to fail.”

The revelations of meetings between green industry leaders and high-ranking government officials highlight the need for greater transparency and accountability in the allocation of taxpayer funds. The concerns raised about the management and disbursement of the Inflation Reduction Act’s funds underscore the importance of safeguarding taxpayer dollars. The Biden administration must address these concerns to ensure that taxpayer funds are used responsibly and effectively.